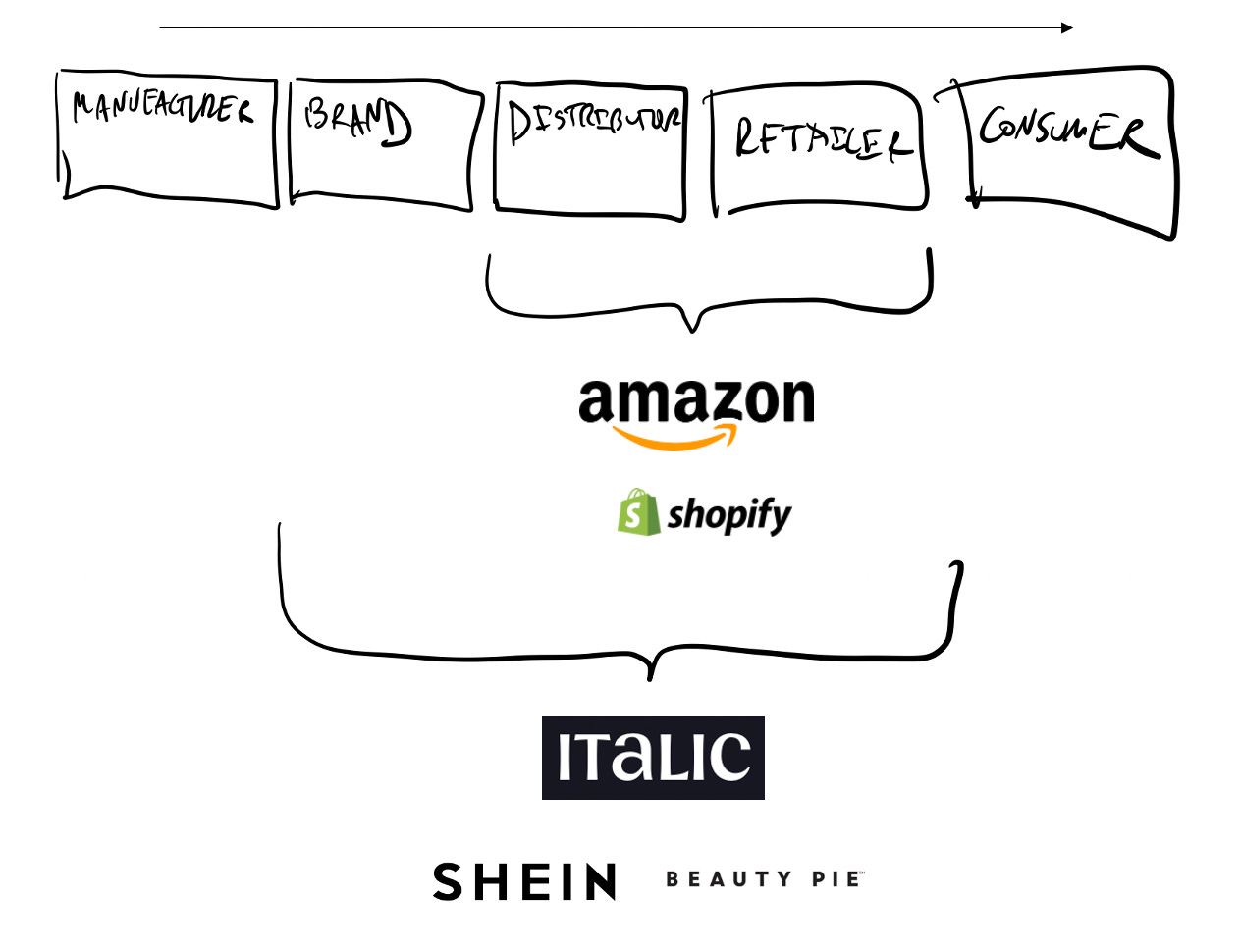

Today, we are thrilled to announce our partnership with Jeremy Cai and rest of the Italic team in leading the company’s $37M Series B, where I’ll be joining the board. Italic has pioneered a new model of internet commerce, called consumer to manufacturer (“C2M”), which for the first time empowers manufacturers to become brands and sell directly to consumers. With a vertically integrated software stack that includes cross border payments, supply chain management and fulfillment, Italic’s product is empowering the same manufacturers that produce for the world’s leading brands, such as Prada, The Four Seasons and All-Clad, to sell under their own namesake brands at 50-80% more affordable prices. We believe every major shift in internet commerce, from eBay to Amazon to Shopify, has involved new tooling and infrastructure that unlocks a new supply of merchants, resulting in disruptive and superior customer experiences. If the last decade was the story of Amazon and Shopify bringing new and existing brands online, then the next decade will be about Italic empowering manufacturers to become brands themselves.

In this post, I’m going to dive deep into why Italic represents an opportunity bigger than just a new marketplace and has the potential to obviate both brands and retailers. This post will dig into (i) why e-commerce is still nascent (ii) the machinery behind Italic’s product and (iii) how e-commerce will be defined in the next decade for consumers.

Early innings of e-commerce, despite being monopolized by Amazon

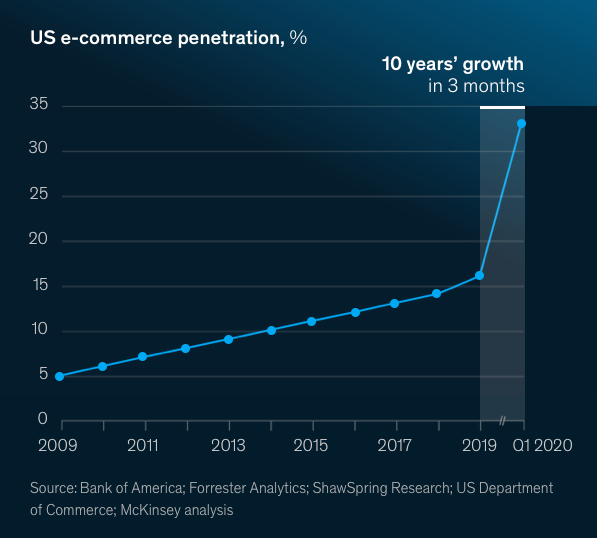

For several months during the height of COVID-19, a statistic circulated across Tech Twitter so widely it was almost inescapable, showing the rate of ecommerce penetration in the US growing by 10 years in a 90-day period in 2020, so it went. But this number alone ignored the fact that ecommerce growth and market share remains largely monopolized by Amazon with 40% share, followed by Shopify at 9%.

Indeed, the virality of this statistic obfuscated multiple caveats to the narrative that the COVID finally primed the US for ecommerce acceleration:

Amazon dominates: not only does Amazon dominate U.S. ecommerce as a whole but the vast majority of ecommerce growth has been historically driven by Amazon. Amazon, unsurprisingly, grew its U.S. retail business an estimated 39 percent in 2020 and increasing its market share to 40 percent of all online retail in the US, according to eMarketer.

Penetration still low: e-commerce penetration and penetration growth varies widely by category, with digital purchases in categories such as beauty/toys/pet still below 10% penetration.

Massive audience still offline: Although the most frequent online shoppers are now shopping even more than before, COVID has not quite accelerated a swell of net new online shoppers. According to surveys conducted by the RAND Institute, the share of respondents under 35 who shopped online at least once per week increased by 14% during the pandemic. Similarly, for shoppers 35-54 and 55+. Yet the share of respondents who almost never shopped online remained largely unchanged across age groups.

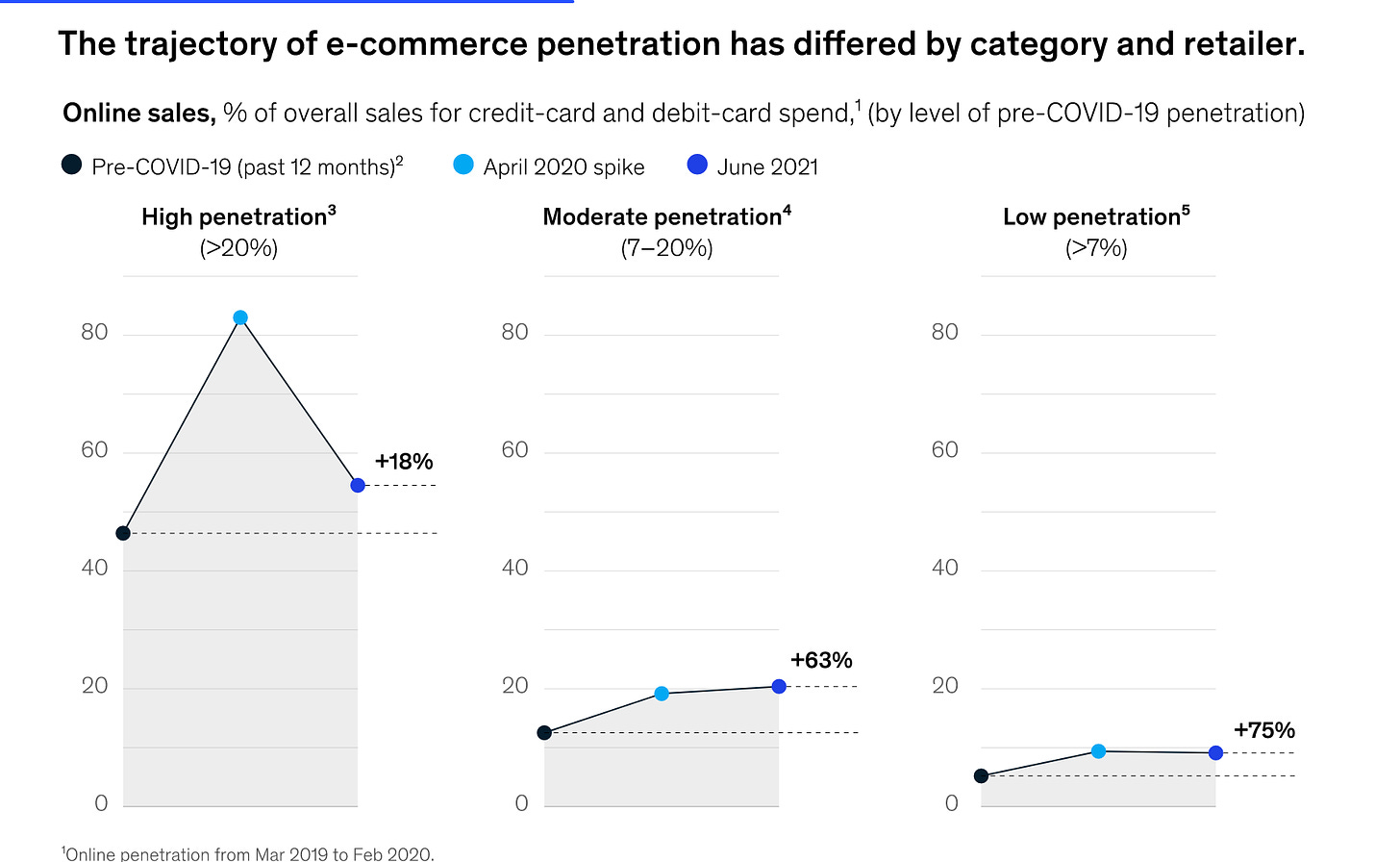

Room to grow: as the graph below demonstrates, relative growth rates can be deceiving in understanding just how much market expansion is left within horizontal ecommerce. Many categories with moderate and low e-commerce penetration (home stores, mass stores, drug stores, grocery) may have experienced significant relative growth but have miles to go from an absolute perspective, suggesting ample room for new e-commerce platforms to emerge.

Source: McKinsey Consumer Sentiment Survey 2021

How Italic works

Italic is a technology-led, commerce infrastructure company that happens to have a horizontal, consumer-facing marketplace on top. Taking lessons from other dominant e-commerce companies such as Amazon, Shein and Alibaba, Italic made infrastructure a core pillar of its DNA, recognizing that owning the end to end experience in e-commerce has resulted in a dominant, competitive advantage. Because of his family’s background in manufacturing, Jeremy understood that building tooling for these exceedingly-offline and increasingly squeezed players in the value chain would translate to a software-led moat, much like what Shopify has done for SMBs. What does that mean in practice? By enabling manufacturers to take inventory risk and becoming brands themselves, Italic’s platform transforms a manufacturer to control more of its own destiny while increasing profits. Italic’s software and distribution lifts manufacturers out from the bottom of the value chain, receiving the least profit for the most complicated work, and connects them to the consumer. Thus both the manufacturer keeps more profit and the consumer saves substantially.

This concept is not entirely nascent to retail, with the $36BN fast fashion category employing a similar model to adapt to rapidly changing fashion and seasonal trends. Under the hood, fast fashion is an exercise in creating hyper efficient supply chains where consumer insights are directly connected to the manufacturer, bypassing the traditional fashion value chain and producing some of the world’s largest companies.

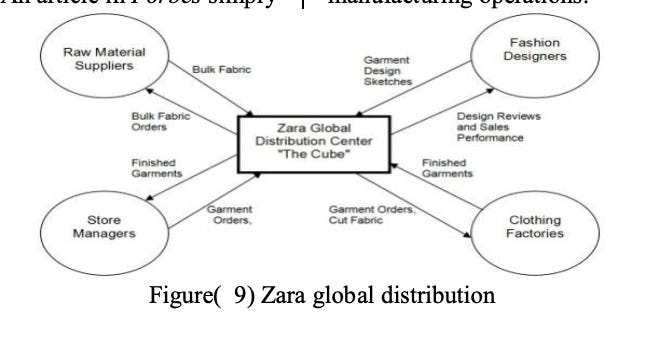

Zara, as an example, centralizes its supply chain around a 5M square foot, highly-automated distribution center in Spain, known as the Cube, where new items are designed, raw materials are gathered, and finished products are shipped to stores. To take the term “vertically integrated” to a new level, eleven Zara-owned factories are connected to the Cube via underground monorail. Zara designers scour the world for new trends, quickly sketch ideas, and send those back to the Cube. At the Cube, Zara manages tons of raw materials, which its factories can quickly leverage to sew into garments from only the available stock of materials. Most of these fabrics are undyed, enabling Zara to retain control over processing and rapidly alter styles according to customer demand. And for more standardized production runs, Zara outsources to lower-cost suppliers across Asia. What results from this extreme vertical integration is the capacity for short product life cycles and resilience against demand fluctuations, thus making Zara the most successful fast fashion brand on the planet. By offering the most relevant products to consumers in the exact minute they are online or in store, Zara unlocks incredible lifetime value and a repeat velocity that the majority of retailers on the planet would be envious of. Today, Zara produces over 450 million items and launches around 12,000 new designs annually, and that is largely because of how automated the supply chain and manufacturing processes are for the company. Inditex, Zara’s parent company, has a market cap of $112B, making it the largest fashion company in the world.

Source: Supply Chain in the readymade garments industry, Dr. Amany Aabed

What is critical here is not just the speed of the production cycle or the centralization of distribution, warehousing, and manufacturing, but that Zara — and fast fashion brands, more broadly — view manufacturing and supply chain management innovation as a competitive advantage. In Zara’s case, that leverage produces industry leading stylistic relevance and merchandising. But Zara and other fast fashion brands are quickly being outmaneuvered by entrants like Shein. How are they being outmaneuvered? Ironically, on the same battlefield that Zara first identified as its endemic advantage: supply chain and manufacturing technology.

In their widely-circulated Substack on Shein, Packy McCormick and Matthew Brennan contend that it is Shein’s supply chain management software, above all, that is responsible for the company’s meteoric success of late. They note that, unlike other retailers, Shein required all its suppliers to use their proprietary supply chain management software, aggregating the hundreds of factories Shein relied on to produce its garments into a centralized, cloud database. For some of Shein’s factories, this marked the first time they were using software at all. For others, Shein’s mandate meant abandoning their own internal software choices. Yet what the blanket software mandate meant was that Shein could outproduce a previous generation of purely “fast” fashion. Thus, the factory was closer than ever to the consumer base — in fact, it was a just a few clicks away. Shein automated away a designer who sniffed out changes in consumer taste by connecting consumer behavior on the website directly to the factory floor. Is it any surprise then that the company reportedly did $10B in revenue last year?

Just as Shein is taking on fast fashion via improvements in back-end technology, Italic is taking on the entire landscape of brands, new and legacy, via the very same technological improvements. But with one important difference: Italic is catering to an entirely different class of suppliers. If Italic is to empower manufacturers to act like merchants, these manufacturers cannot be the same that supply horizontal marketplaces as quickly as possible. In fact, none of the suppliers in Italic’s network can be found on Alibaba or Amazon. When starting Italic, Jeremy spoke with 150 manufacturers around the world, and the team partnered with only the very best, vetting each rigorously on environmental standards, material procurement, past brand customers, labor treatment, and craftsmanship. These are the manufacturers that Italic serves. These are the manufacturers that have the cashflows to take on inventory risk because they know that their margins will be 2-3x higher by partnering with Italic.

How do you do that? Certainly, much of the technology that Zara and Shein pioneered is important in that regard, but Italic has engineered its own software stack that serves this very different class of suppliers toward the very different end goal of being a merchant. On the infrastructure side, the company has built its own ERP, PIM, WMS, OMS, IMS, enabling its manufacturer partners to essentially digitize their existing product catalogs and think about ordering as dynamically as Shein’s suppliers do. Importantly, Italic also designed its own China-friendly payment orchestration layer, without which the company could not remit cross-border payouts to manufacturers. This orchestration also eases working capital constraints for manufacturers, who typically are paid after 60-180 days. On the logistics side, the company has optimized an operational network that carries inventory from around the world to the US and plugs into the recent brokering digitizations that have come to ocean, air, and trucking.

In aggregate, this technology constitutes what Jeremy sometimes calls “private label-in-a-box,” empowering manufacturers to regain control over their destinies without lifting a finger. The cross-border commerce, the payments, the logistics and fulfillment — these are services for suppliers without which a manufacturer would have to work with the familiar cast of brands, distributors, and retailers that have crunched them for so long.

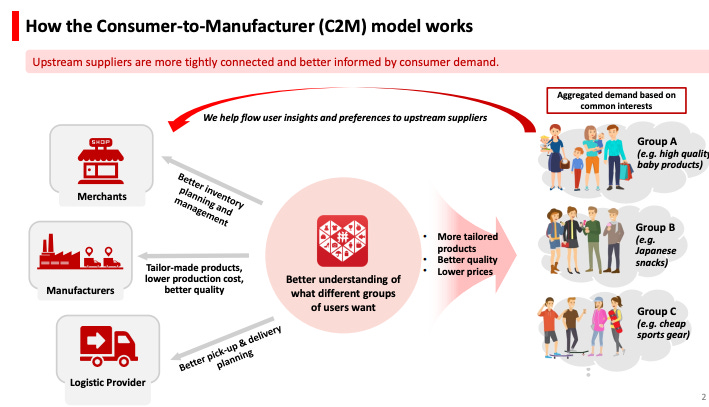

I would be remiss in discussing the empowerment of manufacturers without mentioning Pinduoduo, the $120B Chinese e-commerce giant which pioneered the concept of C2M manufacturing. From the get-go, Pinduoduo’s group buying mechanics were not only a tool to incentivize purchase frequency but also a mechanism for aggregating consumer insights directly to factories who could produce more tailored products. It is estimated that C2M accounts for over half of Pinduoduo’s sales ($9.1B in FY2020).

Although there are important differences between China and the U.S. that make the C2M look and feel different here, how Italic empowers manufacturers mirrors what Pinduoduo has done for China. For both companies, the manufacturer is not the forgotten bottom of the value chain but actually a key customer. To that end, it is easy to think of Italic as a services provider for these manufacturer-merchants, more akin to a Mirakl, Fanatics or Shopify than a Costco. Italic builds the technology which connects the manufacturer to the consumer. You can even browse products by manufacturer. In this version of the world, the manufacturer actually benefits. And so too does the shopper.

Source: Pinduoduo filings.

New table stakes in internet commerce

The last decade has commoditized consumer expectations around online shopping, namely that wide selection, competitive pricing and fast delivery are table stakes. Some retailers will catch up to these standards, but many will not, making it easier for Amazon and other next generation marketplaces to continue to steal share. As those foundational elements of e-commerce become the norm, we believe competing on value, curation and loyalty will become key advantages over the next decade.

Value has always been an enduring driver of American retail culture, but has persisted largely offline in experiences such as Dollar General, Costco and TJMaxx. The rise of direct to consumer brands in the last few years has produced several scaled players in specific end markets, but overall being digitally native has proven to be an important, modern way to build a brand, balanced by the growing costs of actually scaling (ie. “CAC is the new rent”). Value-based retailers including Walmart, Target and Costco have made massive e-commerce progress catalyzed by COVID but still lag Amazon substantially in market share, further challenged by the fact that most supply exists elsewhere online. What we love about the Italic model is that the products and brands (ie. manufacturers) that they are bringing online do not exist anywhere else in the world - online or offline - and by cutting out legacy brands in the value chain, there are fewer costs that can be passed on as savings to the consumers. This is the next iteration of the internet being deflationary on retail.

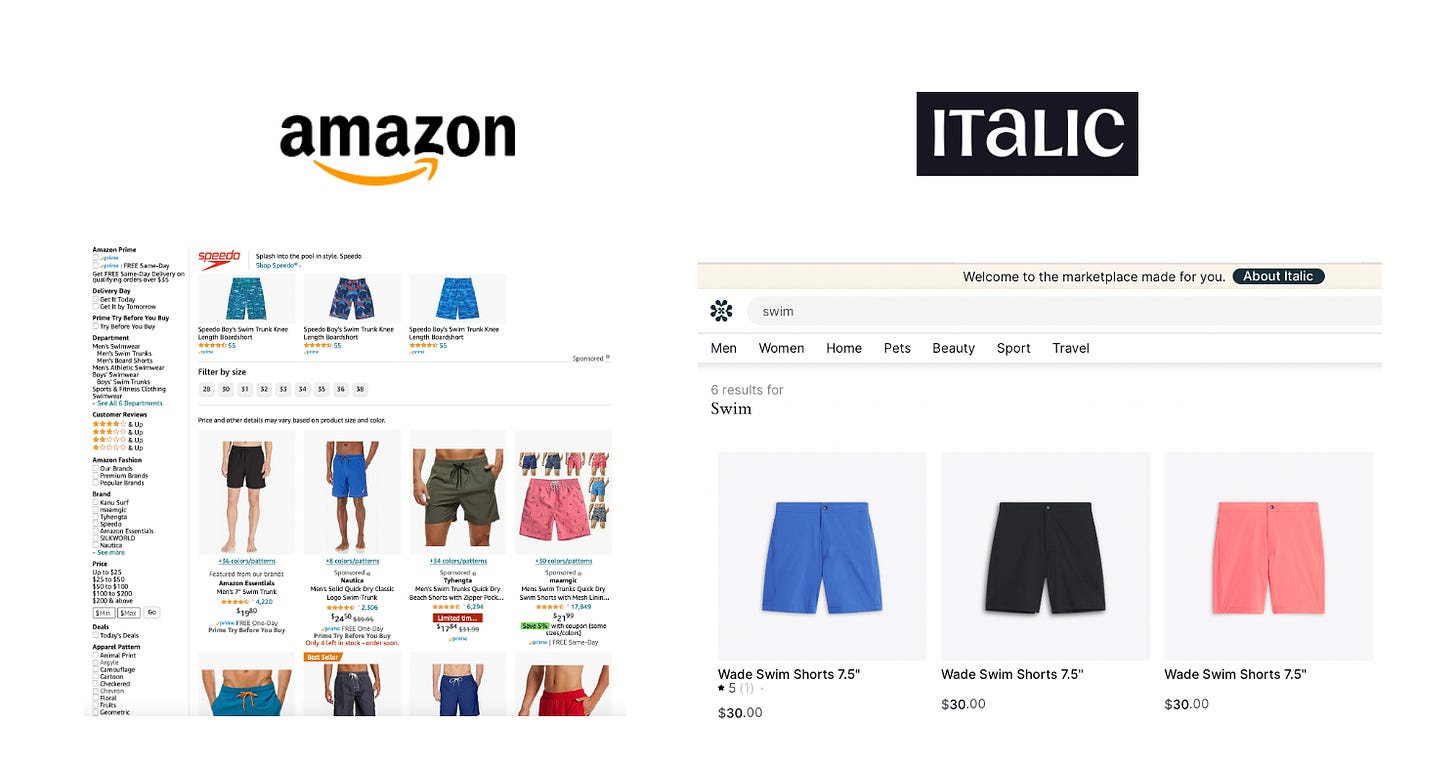

Much has been written about the role of curation and personalization in e-commerce over the last decade, but most of the market capitalization has been won by search-based, high intent marketplaces such as Amazon, Wayfair, Etsy and Chewy. As e-commerce moves from early adopter to late majority, the proliferation of consumer options will force the best platforms to become experts at curating products and merchandising at an individual level, optimizing further on conversion and retention. This doesn’t mean reducing selection, but rather building unparalleled trust with the consumer to minimize search paralysis, decision anxiety and deliver experiences that become the first natural search rank in their head for their next purchase. In the case of Italic, they don’t have thousands of swim trunks that require endless pages of scrolling (burdened further by ads), but rather a few options that have been hand picked and designed by their manufacturer partners, with the responsibility of ensuring a high quality product that fits your needs. If the last decade involved the unbundling and “infinite shelf” of the internet, we think there will be a re-bundling towards higher quality goods with the least friction to usage.

Lastly, a new model of loyalty will emerge in e-commerce that better aligns the customer’s needs with that of the platform. Amazon Prime continues to be perhaps one of the world’s greatest loyalty program, launched in 2005 and nearing 200M members worldwide, adding nearly 50M new members since the beginning of the pandemic. The next generation of e-commerce platforms will need to think beyond the basics of enhanced free shipping offers that have become table stakes for a simple email sign up and become wildly creative in how our increasingly 24-hour, connective internet tissue can create faster, more accurate feedback cycles to support customers and suppliers. In the case of Italic, they offer Italic Bold, the company’s version of Amazon Prime, which offers credit incentives for detailed user reviews, user generated product images and other behaviors that provide valuable data for suppliers to rapidly improve existing and design new products. By adding game-like elements to the end to end shopping experience, including post-purchase, Italic is aligning it’s loyalty program (consumers) with that of its suppliers.

Looking ahead

In many ways, the last decade of e-commerce in North America has been massively beneficial for consumers - same day to two hour delivery, a plethora of new brands being built online, and step function increase in global commerce capabilities. At the same, it’s been fairly boring in terms of innovation on how we discover new products, the lack of social fabric woven into our commerce experiences and almost minimal innovation in rethinking how the internet can continue its path of collapsing more and more of the value chain. We think Italic is pioneering a new model of internet retail that will become a defining part of the next few decades and are thrilled to partner with them on this journey.

*A big thanks to Jared Newman for helping pull this post together.

Very interesting! thank you for the article!